UNEXPECTED EVENTS CAUSE DISRUPTIONS IN DAYS AND WEEKS, NOT IN THE MONTHS AND YEARS, THAT ARE REQUIRED TO BUILD SUPPLY CHAIN RESILIENCE.

Written By Jeffrey Cartwright, Shoreview Managing Partner | 5 min read

On October 7th, Hamas launched an attack from Gaza on southern Israel. Israel responded with an invasion of Gaza. The Houthis in Yemen have responded with attacks on shipping through the Red Sea at a bottleneck known as the Bab al-Mandab. It is 31 miles long and 16 miles across at its narrowest. Well within the range of missiles and drones from various sites in Yemen.

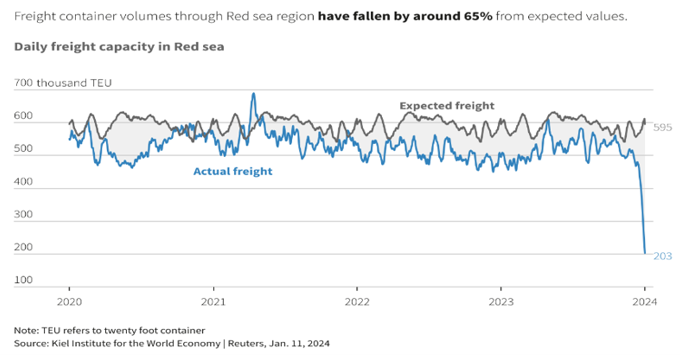

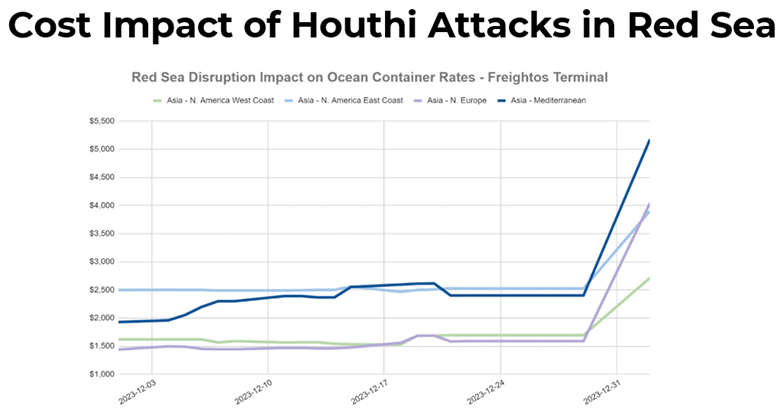

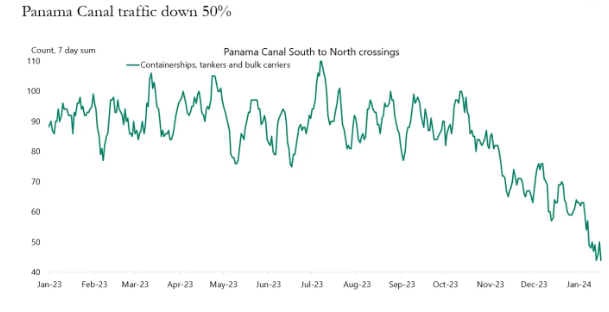

The short-term effect, within weeks, is a dramatic decrease in shipping (65% down) and a doubling of ocean shipping costs from China to Europe (up over 250%). Because shipping schedules are tightly planned, and the number of containers available are globally planned to match shipping volumes, there are effects on other shipping lanes as shown in the chart below. This will get much worse.

There are reports from China of insufficient containers available to load as they are on ships that are spending longer time at sea. Rates from China to the US West Coast have increased by over 60% – so far. These increases have occurred in less than a month, well shorter than any planning window for any software or the best of logistics companies. Better supply chain planning in the near term is simply incapable of foreseeing or reacting to such dramatic changes in such a short period of time. Further effects include the closing of a number of factories throughout Europe due to inability to receive component parts in time to meet production schedules.

For those companies reliant on buying from or selling to China, the Strait of Malacca should be of grave concern. The Strait of Malacca is nearly 500 miles long and is 40 miles wide at its narrowest point. However, the water depth is shallow at the south end of the strait, which narrows the shipping lane itself to 1.7 miles across. One terrorist group like the Houthis with missiles and drones could wreak havoc on shipping. Conflict between China and Taiwan could result in closure of the strait from a mine laying ship or from a single submarine. If so, the effects on Global Trade would be much more dire than a mere disruption.

The volume of trade passing through the Strait of Malacca is enormous. $3.5 Trillion worth of products transit each year. Two-thirds of all China trade ships through the strait, and China is dependent on the Middle East for 80% of its oil.

The time from the beating of the war drums to outright conflict is historically very short. The assassination of Archduke Ferdinand on June 28th, 1914, to the start of World War I on July 28th, 1914, was just 30 days. Germany signed a non-aggression pact with the Soviet Union on August 23rd, 1939, and invaded Poland on September 1st, 1939, or one week later, to start World War II in Europe. Relationships between Japan and the United States had been rocky for some time, but the Japanese attack on Pearl Harbor to start World War II was a surprise. More recently, North Korea invaded South Korea on June 25th in a surprise attack, and the US deployed troops to South Korea 5 days later.

For those who think things might be different this time, Russia invaded Ukraine with no notice following about a month of threats. Hamas invaded southern Israel with no notice.

If China attacks Taiwan (and it reserves the right to use force if necessary to reunify Taiwan and China), it will not be with months of notice so all the importers in the US will have time to plan re-sourcing of their supply chains. Also, recall that President Xi directed his military to be ready to invade Taiwan by 2027, according to CIA Director Burns on February 3rd, 2023.