THE SURGE IN CHINA COSTS REQUIRES NEARSHORING.

Written By Jeffrey Cartwright, Shoreview Managing Partner | 7 min read

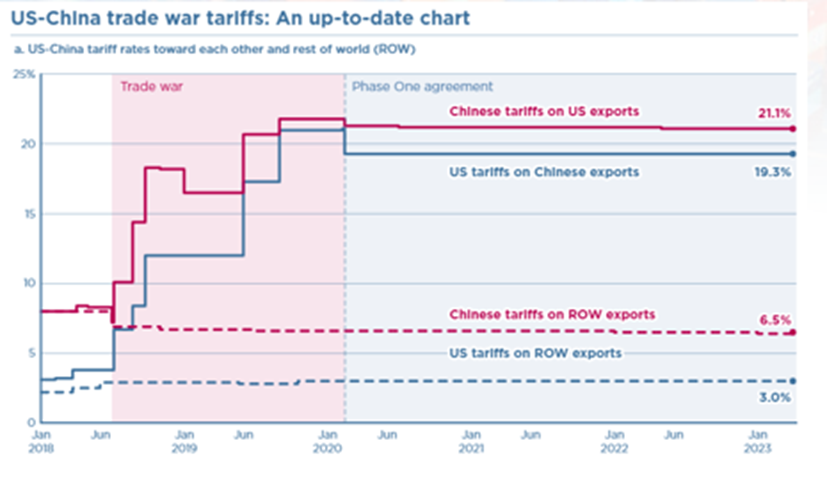

Furthermore, the persistent trade disputes between China and the United States introduce additional layers of complexity. It is critical to underscore that tariffs and duties imposed on U.S. goods entering China have historically exceeded—and continue to exceed—those applied to Chinese imports to the U.S., a pattern consistent with China’s trade relations with the Rest of the World (ROW).

Finally, shipping logistics have faced significant upheavals due to the ongoing global pandemic, compounded by geopolitical disruptions such as the Houthi attacks impacting maritime routes in the Red Sea. These compounding factors are reshaping the commercial terrain, underlining the urgency for corporate decision-makers to adapt to these evolving challenges with informed strategies and decisive action.

Leading economists suggest that China’s current economic dominance makes global decoupling unlikely, at least in the near term—but this need not be a permanent state of affairs.

Consider the case of Japan. In 1995, Japan’s GDP was a staggering 73% of the United States, leading many to speculate that it would not be long before Japan overtook the US economically. However, fast forward to 2023, and Japan’s GDP has dwindled to a mere quarter of the United States. Once a cautionary tale of economic forecasts gone awry, Japan’s previous economic trajectory bears a striking resemblance to China’s current situation, which in 2022 also reported a GDP constituting roughly 73% of the United States.

For years, a similar chorus of economists has projected that China’s burgeoning economic profile would eventually surpass that of the United States. Yet, the evidence is mounting that China’s economic growth has reached its zenith and is now contending with formidable headwinds rooted in demographic challenges, among other factors.

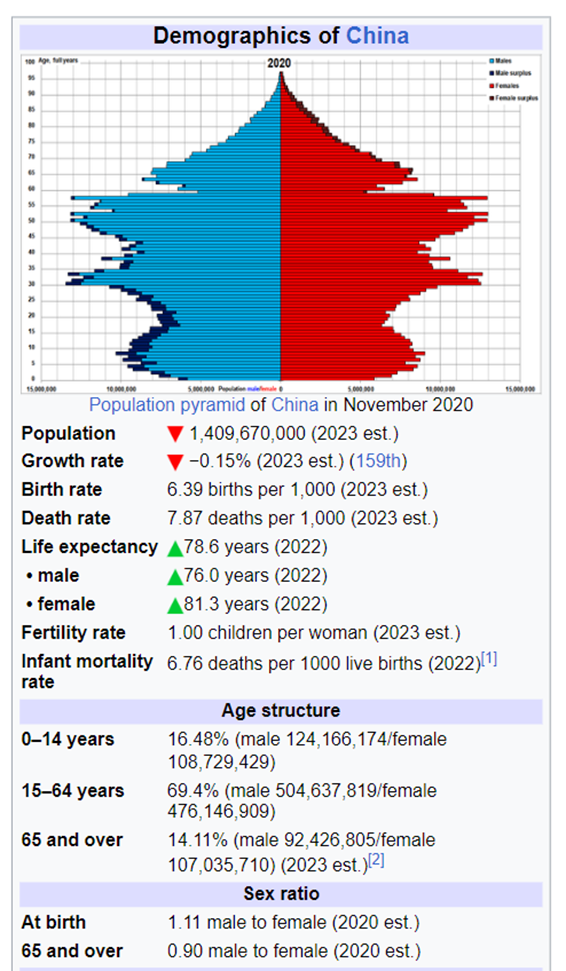

The repercussions of China’s one-child policy, which has only recently been rescinded, will be profoundly felt in the imminent labor market shift. We’re poised to witness approximately 28 million individuals exiting the workforce into retirement in 2024 alone, with a forecast of 300 million over the following decade. The worker-to-retiree ratio, which stood at 5 to 1 in 2020, is anticipated to plummet to 2.4 to 1 by 2035 and even further to a stark 1.6 to 1 by 2050. This disproportionate population aging will necessitate a substantial reallocation of resources toward eldercare, inevitably diminishing the funds available for reinvestment within the broader Chinese economy.

What we are facing is a palpable and potentially irreversible slide in China’s demographic structure, leading to a postulated decline in population from today’s 1.3 billion to a projected 800 million by the end of the century. The message here is unequivocal for executive leaders and carries significant implications for global investment, supply chain strategies, and international commerce. The impending demographic shifts in China are not just predictive analytics; they represent a clarion call for businesses to reassess their long-term plans in relation to the world’s second-largest economy.