Written By Jeffrey Cartwright and Lawrence L. Allen | 12 min read

As nearshoring seems to finally be approaching its long-anticipated inflection point Mexico must not only master the rules of the game but be prepared to play to win. This article offers proven strategies and tactics that would help Mexico sharpening its game and ensure the country is lifted up by its new-found global attention. Consistent with the previous two articles in this series, it offers solutions that enhance Mexico’s ability to “think global and act global” at the governmental, corporate leadership and cultural levels, while helping the USMCA alliance ensure a stable and reliable supply chain for North America and beyond.

CHINA’S HIGH-STAKES GAME

When China’s government reopened its nation to the outside world in 1978 they realized they had two things of value that the world wanted: the promise of access to 1 billion new consumers and cheap labor. Facing the unprecedented challenge of unwinding a society built on total government control, one that had been isolated from the rest of the world for 30 years, Paramount Leader Deng Xiaoping’s game plan was remarkably straightforward: “We shall cross the river by feeling for the stones with our feet.” Over the subsequent 45 years, China deftly played a game of high-stakes poker with the world, using every means possible to ensure that China was lifted up by those who flocked to her shores with their money and know-how, and with favored-nation status and WTO membership in hand.

When China’s government reopened its nation to the outside world in 1978 they realized they had two things of value that the world wanted: the promise of access to 1 billion new consumers and cheap labor. Facing the unprecedented challenge of unwinding a society built on total government control, one that had been isolated from the rest of the world for 30 years, Paramount Leader Deng Xiaoping’s game plan was remarkably straightforward: “We shall cross the river by feeling for the stones with our feet.” Over the subsequent 45 years, China deftly played a game of high-stakes poker with the world, using every means possible to ensure that China was lifted up by those who flocked to her shores with their money and know-how, and with favored-nation status and WTO membership in hand.

Today, Mexico doesn’t have to feel for the stones with its feet in order to join the “manufacturer to the world” club. It can follow in some of China’s proven footsteps for ensuring that Mexico is also lifted up by those now arriving on her shores looking to manufacture in Mexico.

WHAT MEXICO HAS THAT CHINA DOESN’T

Well covered in our March 18, 2024 article “Mexico Must Rise To The Challenge of Nearshoring,” Mexico already enjoys a respectable industrial base that is disbursed relatively well across the country. As of 2023 the USA now imports more from Mexico than it does China, albeit largely from US companies’ OEM component manufacturing. So, the infrastructure—from trucking and ports, to banking and a trained workforce is there for Mexico to step up to being a full-fledged manufacturer to the world.

Mexico and the USA of course share a border, reducing supply-chain time and expense, and Mexico enjoys the “low-cost production” role in the USMCA alliance. Mexico and the US are both CAFTA-DR FTA (Dominican Republic-Central America-United States Free Trade Agreement) members, which puts the entire adjacent region on the table for near-sourcing components, while still enjoying trade agreement benefits. It is therefore appropriate for Mexico to see itself as a leading country within a large regional economic zone.

As the saying goes: “Of all the variables for success, the one you wish you could control the most is timing. Because you can sell an average idea at the right time, but you can’t sell a brilliant idea at the wrong time.” And now is Mexico’s time. The COVID experience thoroughly soured the world on China’s reliability as a trading partner, with US attempts at strategic decoupling one result. On top of that, China’s recent bad behavior toward its foreign-invested companies and relatively high labor cost has made it far less desirable. Far flung supply chains in general are out of fashion for sake of present and potential disruptions. So, as far as the USA is concerned, sourcing from Mexico is the way to go, both for the present and the foreseeable future.

China once dominated the table with the winning hand of the promise of a billion consumers and low-cost labor, but if Mexico plays its cards right it can have a winning hand with proximity and low-cost reliability. China of course recognizes Mexico’s growing competitive advantage in this regard and has been increasing its efforts to get into the game in Mexico. The question on the minds of many in the Mexican government and business is: can China be trusted?

CHINA’S TRACK RECORD

“The best predictor of someone’s future behavior is their past behavior.”

— Jordon Peterson, Canadian psychologist, author, and media commentator.

So, can China be trusted when it comes to investment in Mexico? The answer is yes, like all human beings and the organizations they control, they can be trusted to have a high likelihood of behaving as they have in the past.

Managing FDI Into China

Among China’s most visible tool for ensuring that FDI (foreign direct investment) was proportionally—in many cases disproportionately—beneficial to China was the mandatory joint venture. For foreign entities seeking access to China’s billion consumers throughout the 1980s, ‘90s and into the early 2000s it was necessary to sell through local Chinese entities in order to not only move product through China’s quirky and undecipherable distribution infrastructure, but to get paid as well. Foreign investors seeking to access China’s consumers had to work with Chinese partners at this most basic level: from the moment the product arrived in a Chinese port all the way to the retail shelf.

Extremely high duties and tariffs on imported goods made it necessary to eventually invest in manufacturing in China in order to profitably access the market. And with that, depending on the industry, manufacturing joint ventures with Chinese entities were mandatory—in many cases with the Chinese partner holding a majority share. If you were going to make it in China you were going to have a Chinese partner at your side, training local Chinese employees and exposing your manufacturing intellectual property secrets.

There were signs that China was intent on playing by its own rules: mandatory joint ventures, forced technology transfers, weak enforcement of IP protection, and in the recent decade the deliberate disadvantaging of foreign invested companies—

many deciding to reduce their stake in China and in some cases leave altogether. One well-known example of China’s impunity with these actions was its 2001 entry into the WTO (World Trade Organization).

many deciding to reduce their stake in China and in some cases leave altogether. One well-known example of China’s impunity with these actions was its 2001 entry into the WTO (World Trade Organization).

China’s economy was completely out of compliance with the organization’s membership requirements in terms of economic liberalization. But China was allowed to enter conditionally, with the understanding that it was to progressively come into compliance. They didn’t. Today, the world’s 2nd largest economy still has only a semi-convertible currency, for example. But the international business community and governmental authorities had no stomach for expelling China from the WTO or otherwise punitively enforcing compliance. The lure of a billion consumers for commercial entities, and the prospect of a peaceful and non-aggressive China for governmental interests, simply proved irresistible. The result was global inaction, apart from the Trump Tariffs.

COMAC C919

Perhaps the most notorious example of China’s predatory commercial practices is the case of Airbus. With the promise of securing more orders in

Perhaps the most notorious example of China’s predatory commercial practices is the case of Airbus. With the promise of securing more orders in

China, Airbus built a final assembly line in Tianjin, China in 2008 to produce the A320. There were assurances from the Chinese government that no Chinese employee hired and trained by Airbus would ever be eligible to work at COMAC, Commercial Aircraft Corporation of China. This was not honored and, combined with a massive coordinated industrial espionage effort,1 the China-made COMAC C919 airliner took to the air in 2015.

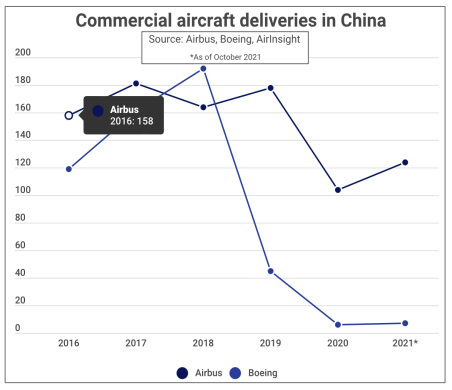

In effect, Airbus trained its China competitor in exchange for the promise of high sales, but Airbus and Boeing commercial aircraft deliveries in China are not growing.2 This is how China plays the game when it is on its own turf: it plays by its own rules whenever the rest of the world lets them get away with it.

Managing FDI Out of China

China’s behavior has been no less predatory when it grabs the check book and heads abroad. The most famous of China’s international efforts has been its “Belt and Road Initiative,” a 2013 national mission to create a 21st-century Silk Road through major international infrastructure construction projects around the world. Its purpose is to deal China a new hand at the global economic poker table—one commensurate with its economic power and growing military strength. After 11 years there has been significant criticism involving circumventing established international norms, economic benefits being hard-wired to geopolitical military objectives, and achieving all this through coercive practices including creating a “debt trap” for vulnerable nations.

For Mexico, thus far, there have been a number of successes with Chinese investment, but also a lot of talk and tire-kicking, resulting in rising but relatively low-level investment. If China intends to continue its access to the US market, and fully circumvent US duties and tariffs, it needs Mexico in its supply chain. How can Mexico leverage this to its advantage?

CHINESE FDI: A STRATEGY FOR LIFTING UP MEXICO

What is the benefit to Mexico when a Chinese company re-routes a shipment of Made-In-China goods through Mexican ports so they can declare them “Made-In-Mexico” and circumvent US tariffs?3 Sure, there is the new revenue for the shipping, warehousing and trucking industries, but given the massive value changing hands, that is in essence China tossing Mexico a chip from the big-boy poker table: a mere token from China’s billions in savings. And where does that leave Mexico? Its industries and wealth of the nation? How does it benefit the Mexican people?

If size and resources were all that mattered the world wouldn’t have Switzerland, Singapore, and Hong Kong. Mexico may be smaller when compared to the world’s top two economic giants, but it should never accept China using Mexico as its “coolie,” to move its goods into the USA in order to scam a trade organization that Mexico is a part of.

If size and resources were all that mattered the world wouldn’t have Switzerland, Singapore, and Hong Kong. Mexico may be smaller when compared to the world’s top two economic giants, but it should never accept China using Mexico as its “coolie,” to move its goods into the USA in order to scam a trade organization that Mexico is a part of.

Mexico has a great hand with its USMCA membership, proximity to the USA and low-cost supply chain reliability. It must play those cards much more aggressively, and that can be done by standing shoulder to shoulder with the USA within the USMCA alliance. Mexico would do well to remember that the USMCA is to be reviewed for renewal in 2026. Given that both US political parties are very concerned about Mexico enabling China to avoid tariffs through supply chain circumvention through Mexico, there is significant risk to Mexico losing its privileged status within the alliance during a renegotiation.

As of the writing of this article, the US government is handing a huge bargaining chip to Mexico when negotiating with China. The US government is now mandating a “melted and poured” standard for steel and aluminum entering the United States. This forces China’s hand to actually build foundries and smelting operations in Mexico if they wish to enjoy tariff free entry into the USA.4 Top Mexican industries should now be working with their government to reach out to Chinese steel and aluminum producers directly, inviting them to discuss steel and aluminum manufacturing joint ventures in Mexico, with the promise of expedited processing, rapid start-up time, and land and tax incentives. Such joint ventures will bring all the same benefits to Mexico that China’s joint ventures brought to its economy: real manufacturing know-how, equipment and a skilled workforce. Mexico should demand no less.

Where China once dangled the shiny objects of access to a billion consumers and cheap labor, Mexico must now do the same for China: dangle Mexico’s lower cost labor (yes, below China’s now) and its tax-free, privileged access to American consumers!

TAKE CONTROL

China overcame deep animosities toward Japan when opening its door in 1978; the horrors of Japan’s brutal invasion and occupation during WWII still fresh in the memory of its older citizens. But rather than exclude Japan, China derived benefit from Japan’s investments in China over the past decades, though through a deliberate policy of limiting Japanese investment. China would not allow Japanese companies to dominate in any one sector, such as automobiles and electronics.

Mexico should play the same way with its foreign investors through balancing investments and diversification. It can achieve this by actively courting Japan, Korea, Taiwan, Vietnam, India and the other “Asia Dragons” that wish to compete for access to the US market. Doing so not only prevents a single nation gaining undue leverage over Mexico (the way many Belt and Road Initiative countries have fallen prey to), it also fosters competition between foreign investors to the disproportionate benefit of Mexico!

Set Goals and Measure Performance

Though the saying “If You Can’t Measure It, You Can’t Manage It” has gone out of vogue, that doesn’t make it untrue. Mexico, its government and industrialists, must proactively track and measure performance in order to manage its transition to manufacturing powerhouse. This is essential for Mexico becoming as adept at playing the game as China has been, and still is. For example, TFP (total factor productivity – how much is produced versus what is needed to achieve that result) has been declining in Mexico, while improving in places like China, Taiwan and South Korea. This would be a good measure for Mexico to use for driving its strategy when managing FDI into the country. It will measure how Mexico’s FDI strategy is improving the country’s competitiveness within the manufacturers to the world club and help guide course adjustments along the way.

A Safe Environment for FDI

Another thing Mexico can’t be passive about is IP protection. Although Mexico isn’t a large generator of commercial intellectual property, the foreign investors into Mexico from the USA, Europe and Asia are. And China has no reason to change its behavior once operating in Mexico. Indeed, China has been very aggressive with co-opting IP directly from American universities and corporations in the United States. According to a CBS News report, China stole trillions in intellectual property through industrial espionage from about 30 multinational companies over recent decades.5 It is important to recognize that the Chinese government is always looking over the shoulder of its companies and people abroad. Foreign investors don’t want to go to the trouble of moving operations out of China to Mexico, only to have China steal its intellectual property there. A rigorous IP defense legal infrastructure and close cooperation with IP security protection entities would go a long way toward allaying those concerns.

Another thing Mexico can’t be passive about is IP protection. Although Mexico isn’t a large generator of commercial intellectual property, the foreign investors into Mexico from the USA, Europe and Asia are. And China has no reason to change its behavior once operating in Mexico. Indeed, China has been very aggressive with co-opting IP directly from American universities and corporations in the United States. According to a CBS News report, China stole trillions in intellectual property through industrial espionage from about 30 multinational companies over recent decades.5 It is important to recognize that the Chinese government is always looking over the shoulder of its companies and people abroad. Foreign investors don’t want to go to the trouble of moving operations out of China to Mexico, only to have China steal its intellectual property there. A rigorous IP defense legal infrastructure and close cooperation with IP security protection entities would go a long way toward allaying those concerns.

The manufacturer-to-the-world waters that Mexico is now entering are neither uncharted nor hidden. They are, in fact, well explored and quite visible. Examples abound, not only within Greater China, but with other nations within the Bamboo Network: Philippines, Malaysia,

Indonesia, Singapore, Thailand, and Vietnam. We can observe Chinese companies’ mode of operation when moving manufacturing from China to these countries: which industries are moved first, second, then third. Same for component manufacturing. And which countries are first and last within their sequential strategic offshoring, and why. How extensive their expatriate (Chinese) management is in these countries, versus indigenous talent. And so on. If it can be observed and studied, it can be emulated and exploited to Mexico’s benefit.

Indonesia, Singapore, Thailand, and Vietnam. We can observe Chinese companies’ mode of operation when moving manufacturing from China to these countries: which industries are moved first, second, then third. Same for component manufacturing. And which countries are first and last within their sequential strategic offshoring, and why. How extensive their expatriate (Chinese) management is in these countries, versus indigenous talent. And so on. If it can be observed and studied, it can be emulated and exploited to Mexico’s benefit.

Critically, Mexico needs to aggressively act in its own best interest and the greater interest of the trade alliances it is a part of. Mexico should jealously guard the USMCA as much as it does its own country; helping competitors shoot holes though the hull of the boat that you’re standing on is not a long-term strategy for success. A clear national will, a “think global and act global” vision, and self-confidence to play and win on the world stage are the pillars upon which any nation can successfully earn its seat at the manufacturer to the world table.

END NOTES:

1 “How China Stole an Entire Airplane,” Industry Week, Jeff Ferry, December 16, 2019, (https://www.industryweek.com/the-economy/article/21118569/how-china-stole-an-entire-airplane)

2 “Airbus v Boeing in China: who has the upper hand?” Aerotime, Valius Venckunas,

October 20, 2021, (https://www.aerotime.aero/articles/29232-airbus-v-boeing-in-china-data)

3 “China Dodges US Tariffs, Boosts Shipments Through Mexico,” Contrank, Eduardo Mayer, February 21, 2024, (https://contrank.com/mexico-trade-routes/)

4 “US, Mexico move to thwart China circumvention of tariffs,” Reuters, David Lawder, July 10, 2024, (https://www.reuters.com/markets/commodities/us-mexico-move-thwart-china-circumvention-us-steel-aluminum-tariffs-2024-07-10/)

5 “Chinese hackers took trillions in intellectual property from about 30 multinational companies,” CBS News, Nicole Sganga, May 4, 2022, (https://www.cbsnews.com/news/chinese-hackers-took-trillions-in-intellectual-property-from-about-30-multinational-companies/)